The legal obstacles to be overcome before opening a natural stone quarry in Russia are explained. Investments will not be forthcoming without a resolution to these problems. Meanwhile the country´s stone processing factories have to rely to an increasing extent on imports. In this report*, I.O. Sinelnikov & O.B. Sinelnikov propose some practical solutions. (*This article was translated from the Russian original in Gorny Zhurnal 2009, No.3, and appears here by kind permission of the publishers and authors.)

Trading in granite blocks is a long-established international business. With a world trade (export-import) volume of around 4 million m3, Russia exported 3.400 m3 and imported 17.700 m3 in 2006.

The annual volume of granite block production in Russia is around 110.000 m3. This puts the country in 19th place in the world, with just 0,6% of the total. It is hard to imagine why with all its vast territory and inexhaustable geologically proven resources, the domestic stone business is not developing. Countries with a land area hundreds of times smaller than Russia´s produce a far greater quantity of blocks. Italy extracts 12,7 times more, Turkey 10,3 times, Spain 10 times, Portugal 4,5 times, Greece 2,3 times, France 1,9 times, Belgium 1,4 times and Germany 1,2 times more.

The integration of Russia into the world business is being hampered by internal causes. Above all it is due to the limitations of the legal framework at all stages prior to opening a new stone quarry, beginning with obtaining the initial planning documentation and finishing with obtaining the final product. It was during the 1930s that the first document defining technical requirements for blocks of natural stone was published. In this document the dimensions of a commercial block were determined by economic considerations, however in subsequent amendments dimensions were omitted. The latest version, State Standard GOST 9497-98 (published in 1998), classifies blocks according to their dimensions alone. This definition of a commercial block entered into legal practice when calculating reserves and planning stoneworking establishments. As a result, in the USSR and later Russia what is considered as a block would be termed a reject or tombola in the outside world.

Outside Russia there are no federal documents specifying requirements for blocks, except for weight limits for road transport. Block sizes and quality are requested by the buyers, so that the producers establish price guidelines for their products. The minimum size for an ordinary granite block overseas is around 2,5 m3. The more valuable the material the smaller a block can be. In world practice it has long since been known that the slabbing of small blocks is wasteful, however in Russia we are talking about the so-called ´balanced reserves´ and therefore conflicts can arise between the stone producers and the tax authorities. At the present time court proceedings are under way involving the companies Vozrozhdeniye, Vyborg Mining Co. and Oyayarvi regarding taxes on the extraction of natural stone blocks.

Russian producers of blocks, slabs and tiles have been using imported quarrying and processing machines for a considerable time and are fully conversant with the economic aspects of the business. They are aware of the backward nature of the legal aspects still prevailing in Russia and are obliged to import blocks more and more frequently. In some years the country imports up to 30% of its granite block requirements. With the establishment of new stone processing factories, the volume of imports will increase. For example, a new stone processing section at Glebychevsk Ceramics Factory near Vyborg, formally opened in December 2008, purchased granite blocks to a value of 150.000 € in Finland because of the raw material supply problems within Russia.

A big problem

If it remains unsolved, the current situation could lead to an almost complete cessation of natural stone block extraction in Russia, with adverse consequences for the country´s economy. The situation would also aggravate social tensions in depressed regions which have natural stone resources, depriving them of investments, employment possibilities and infrastructure improvements. State aid is clearly needed.

If we consider the use of granites for funerary arts, here in Russia there is a complete lack of rules. Due to a great shortage of gabbro type black stone, buyers will accept any irregular shaped pieces of rock from which they can fashion a slab. Economic considerations are not the determining factor, as all costs are borne by the buyer. Since gabbro is sold for a high price, there is no incentive for the producers to extract blocks or even square irregular shapes. Therefore despite a considerable volume of extraction of gabbro in Russia, the production of commercial blocks is insignificant. The high demand for gabbro-diabase blocks has pushed prices up to crazy levels, with ruinous consequences for block quality. If sold for the memorial business, prices for blocks are 10 - 15 times higher than for general purpose rubble. In addition, random shaped pieces of gabbro are counted as blocks which distorts the production statistics. As a result, when monitoring the production of granite quarries the authors have distinguished between commercial and random shaped blocks (called tombolas in some European countries ).

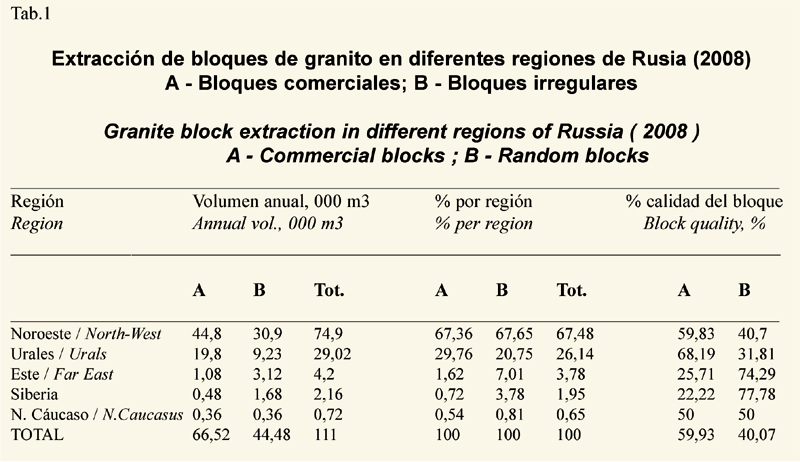

We use the term commercial block for a product whose dimensions correspond to international norms, and which is basically intended for primary sawing on orthogonal sawing or gang sawing machines. What we have termed as random blocks (tombolas) are all remaining blocks classified as such in Russian statistical data but which are not of regular shape (Table 1 ).

As can be seen, the North-West Region comprising Karelia, Leningrad and Murmansk Districts is the main producer of granite blocks in Russia, supplying around 2/3 of the nation´s total.

Currently there are five active granite quarries in Leningrad District, extracting 26,800 m3 of commercial blocks and 1,800 m3 of random granite blocks. In terms of quarrying equipment these quarries are on a similar level to those in Finland. They are equipped in the main with imported rock transporting vehicles, hydraulic drilling machines and diamond wire saws. More than 93% of blocks extracted in the District are of commercial standard. The granite quarries in Leningrad District provide an example of how technology and business in the sector should be maintained.

The Republic of Karelia is distinguished by a high volume of gabbro-diabase blocks extracted (34,800 m3 ) for the memorial trade. The extraction volume is continually increasing, and the materials are being distributed throughout practically all regions of the European part of Russia. This kind of business is the least affected by the global economic downturn, and only 32% of gabbro-diabase blocks extracted can be termed commercial.

The Urals Region produces some 26% of the granite blocks extracted in Russia. The most significant here are the Mansurov and Sibirsk quarries in Bashkiriya and Sverdlovsk District respectively, which extracted 17.800 m3 of blocks in 2008 - together 61% of the Urals production of granite blocks. In terms of their quarrying equipment, the Mansurov quarry operated by OAO Granit is the most advanced. Overall, around 32% of granite blocks quarried in Urals Region can be ascribed to the random category.

The problems facing the sector

Stoneworking factories in Russia which are equipped with modern primary sawing or slabbing machines naturally prefer to buy imported blocks rather than use relatively expensive diamond tools to cut and shape locally produced random size / shape blocks, with a risk of no profit. On the other hand, there are no incentives at present for businessmen to invest in new quarries in Russia. There are even instances of Russian companies investing in granite quarries in Finland.

Basically Russian investors do not want anything to do with the complex and irrational system for obtaining a quarrying license in Russia. Moreover, the legislation regarding generally distributed mineral resources (GDMR), including dimension and decorative stone, is so incomplete that it fails to stimulate the development of granite block extraction. The fact of the matter is that there is no guarantee that commercial blocks can be obtained from a source even if from a geological report the site has been granted the status of a deposit and the reserves have been recorded. The very procedure for confirming reserves is at fault, since it does not guarantee the presence of commercial blocks - without this information there is no sense in opening a new quarry.

In Finland, the main considerations to be taken into account when deciding whether to grant a license for the extraction of dimension stone include the permission of the landowner and the measures proposed to protect the local environment as determined by the federal authorities. In 2 months or less after making an application for a license it is possible to begin extracting stone. There are considerable incentives offered to investors.

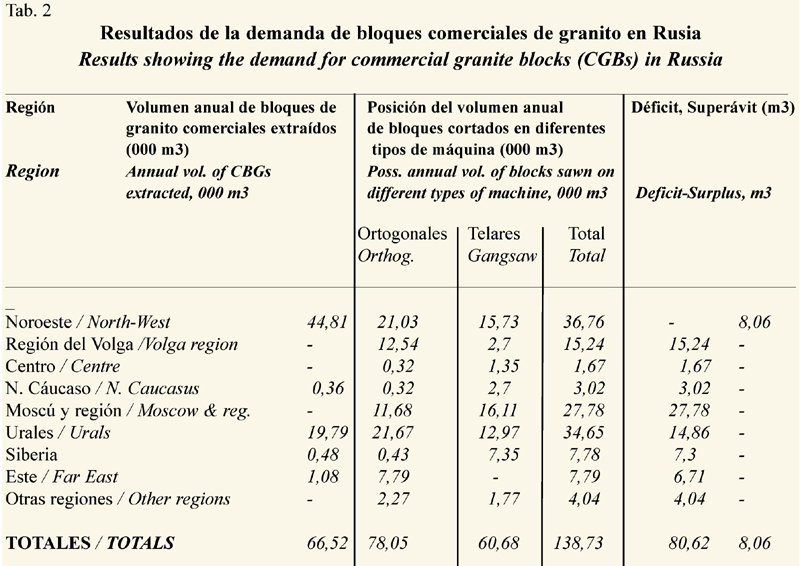

In order to calculate the internal requirements of Russia for commercial blocks, we have monitored the block slabbing machine resources by region. The yield of nominally 20 mm thick slabs from a block, according to world practice, is 18,5 m2/m3. In our monitoring program, we counted the number of orthogonal and gangsaw machines installed in stone processing factories in Russia and established the maximum possible production output when sawing commercial blocks into slabs and tiles, comparing data obtained with the actual volume of commercial blocks extracted and establishing the shortfall or surplus for each of the regions of Russia (Table 2 ).

Our survey revealed that many factories are using machines bought on the second-hand market which are 15 - 20 years old: machine reserves are very limited. As already noted above, the deficit of granite blocks in Russia (by 30 - 40% ) is partly covered by imports from Finland, Khazakstan, Ukraine and other countries, and also by sawing random size / shape blocks with significant losses in efficiency.

As can be seen from Table 2, all stoneworking regions in Russia except for the North-West experience a deficit of domestically quarried granite blocks of commercial quality. But if we also consider the types of granite available, the deficit is considerably greater than the volume figures indicate. For example, the Vozrozhdeniye Company - perhaps the current sector leader in Russia - can meet all its granite block requirements in volume terms, but is obliged to purchase up to a further 30% or so of imports since Russian customers today require granites in a range of colours. For building the "Moscow" Hotel, the architects have requested certain specific types of Finnish granite.

In Russia it would be potentially possible to process 138.730 m3 of granite blocks per annum, although the real figure would be considerably less since many factories process random size / shape blocks or simply do not operate full time as they do not have the means to purchase blocks. In the central part of Russia, including Moscow and Moscow Region, and also Volga Region, it is necessary to import 44.700 m3 of commercial granite blocks as there are no quarries operating in these areas. Around 15.000 m3 of granite blocks are brought in from Urals Region since with the exception of Mansurov quarry, the remainder are not able to produce very much on account of the limited scope of the equipment installed. A significant volume of granite blocks in Urals Region is imported from Kazakhstan. There is a distinct shortage of granite blocks in the Far East Region and blocks are brought in from the Urals and Kazakhstan. Imports from North Korea are under discussion.

Prices

Prices for commercial quality granite blocks in Russia approach European levels and vary from 7800 roubles/m3 for blocks from Mansurov and Ala-Noskua quarries up to 14.600 roubles/m3 from Baltiiski quarry in Leningrad Region. Prices for blocks of exclusive granites, for example from Syuskyayansaari quarry in Karelia, can reach up to 40.000 roubles/m3. Naturally prices increase with the increasing decorative qualities of the granite. Thus blocks 4,5 - 5,5 m3 in size of Ladoga grey-rose granite cost around 10.000 roubles/m3, of Yelizovsk claret-brown granite around 11.900, and of Baltiiskii claret-brown granite around 14.500 roubles/m3. Blocks of red granite less than 3 m3 in volume from the recently opened Lukunoi quarry cost 13.600 roubles/m3. (Exchange rate approx. 42 Roubles/€).

Prices for granite blocks on the internal Russian market have undergone some radical changes. Previously the main cost factor in the cycle from raw block to finished product was in the processing, and now it is in the raw block.

On the basis of our findings, it has been established that the problem of supplying raw materials to Russia´s granite processing factories has not been solved. There is a need to open new quarries and improve the technical equipment level of existing ones. An additional 65.000 m3/year of commercial quality granite blocks needs to be produced to meet the demand. To solve the sector´s problems requires State aid, above all in transforming the legislative processes in order to stimulate investment and effective land use.